MetroBank Transforms Tech

Landscape with Creatio,

Uniting Systems for Accelerated Digital Evolution

MetroBank, a leading financial institution in Panama with over 25 years of experience, undertook an ambitious digital transformation to modernize its operations and enhance customer service. The bank, offering a comprehensive suite of services that includes Private Banking, Corporate Banking, Consumer Banking, and Digital Banking, faced challenges with its existing technology infrastructure, which had become a patchwork of disconnected platforms and complex processes over time. Recognizing the need for a holistic solution, MetroBank turned to Creatio's no-code platform to consolidate its tech stack and streamline operations.

Challenges

Key Deliverables

Navigating a Complex Tech Landscape

Due to the complexity of its operations, MetroBank had to use multiple platforms to address different issues in specific business and operational areas. However, many of these platforms were separate and needed more integration for seamless data flow and process management. The lack of synergy between systems made gaining a holistic view of operations and customer interactions challenging, preventing the bank from responding quickly to market changes and customer needs.

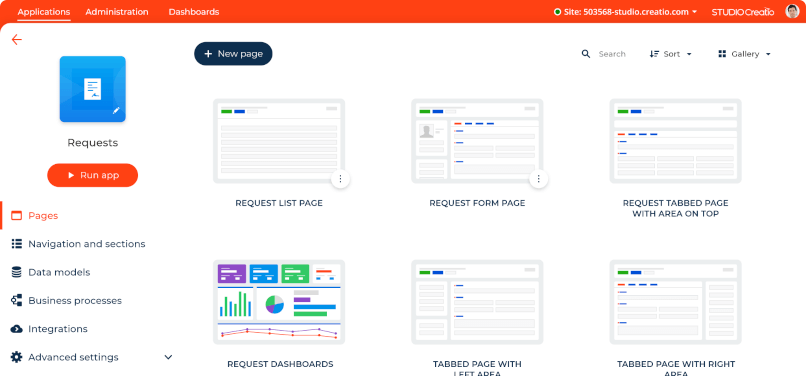

Recognizing its needs, MetroBank sought a comprehensive solution to consolidate and centralize its processes to a single, flexible platform. The organization needed a system that could integrate the existing tools and provide agility to develop and deploy new applications quickly as business needs evolved. After evaluating several options, MetroBank turned to Creatio's no-code platform.

Embracing the Power of No-Code

To validate Creatio's capabilities, MetroBank decided to conduct a proof of concept. It presented the Creatio team with a process that enclosed elements needed to assess the platform's functionality and integration capabilities. The results of this test were nothing short of impressive. In just two days, Creatio delivered a fully functional product that not only met the basic requirements but also successfully integrated with MetroBank's existing systems. This rapid turnaround and the platform's ability to seamlessly connect with their infrastructure provided the bank with the confidence they needed to move forward with Creatio as their chosen solution for digital transformation.

We found the no-code concept and its features intriguing. After setting up a simple proof of concept, we were surprised when, in just two days, they delivered a fully functional product that integrated with our systems. That gave us very positive feedback right from the start”

The no-code aspect of Creatio's platform was particularly appealing to MetroBank. It promised to dramatically reduce the time and resources required for application development. This approach would allow MetroBank to accelerate their digital transformation initiatives and respond more quickly to changes.

A Comprehensive Approach to Transformation

MetroBank's implementation of Creatio represented a fundamental shift in how it approached its operations and technology strategy. One of the first and most impactful steps in the implementation process was consolidating processes. MetroBank streamlined its existing workflows, ultimately condensing approximately 300 processes into fewer than 80. This unification has simplified operations, eliminated redundancies, and optimized workflows for maximum efficiency.

The impact of the Creatio platform has been transformative. In just eight months, we reduced the number of processes on one of our platforms from over 300 to fewer than 80, receiving exceptional feedback from our teams. This wasn't merely a tech upgrade—it was a complete reimagining of how our team works.”

The organizaion was able to optimize its operations, reducing manual interventions and minimizing errors. This improvement in operational efficiency translated into faster service delivery and increased customer satisfaction.

User-Friendliness That Accelerated System Adoption

The new system's impact went beyond operational improvements, and it sparked organizational change. Creatio's platform received overwhelmingly positive feedback from teams across the organization, with employees praising its intuitive interface and the opportunity to actively contribute to process enhancements. This strong reception led to the rapid adoption of the system and nurtured a culture of continuous improvement within the bank.

Furthermore, the implementation of Creatio's no-code platform transformed collaboration and reshaped problem-solving approaches within teams. This shift towards an agile, innovation-driven culture ignited widespread interest in automation initiatives across multiple areas. MetroBank's team, empowered by training in the no-code approach—through studying the No-Code Playbook and earning Creatio certifications—built a solid foundation that allowed them to gain the freedom to automate processes and maximize the benefits of the AI-powered composable platform. This commitment not only equipped the employees with valuable skills but also enabled them to tackle challenges at an unprecedented speed.

Transforming Operations and Empowering Innovation

MetroBank achieved significant operational improvements, particularly thanks to developing and deploying new solutions. The platform's agility streamlined the preparation phase by reducing the time required to document and define processes. These steps, critical for ensuring that new solutions align with operational workflows, regulatory requirements, and customer needs, became far more efficient, allowing the bank to respond swiftly to market demands.

A key advantage of the no-code approach was its accessibility, empowering business users with deep knowledge of banking processes and customer requirements to directly contribute to application development. This democratization fostered collaboration between teams, ensuring more relevant, user-centric solutions.

By enabling rapid application development and modification without coding, the no-code platform accelerated MetroBank’s innovation cycle. The bank could bring new products and services to market faster, adapt to evolving regulations with ease, and respond to customer needs more effectively than ever before.

Connecting the Dots with The Power of Integration

Lastly, the most significant aspect of the transformation was the platform's flexibility and ease of integration. MetroBank successfully connected the new system with its existing infrastructure, allowing to preserve bank's investments in legacy systems while establishing a solid foundation for future innovation. This integration capability ensured smooth data flow across the organization, delivering a unified view of operations and customer interactions.

Given the bank's growth in recent years and the introduction of new business lines and products, it finally have a way to consolidate the tools that support the internal users. Rather than navigating multiple platforms, the bank can now leverage a single source of truth - Creatio no-code platform. As processes are migrated from various systems and integrated into Creatio, which connects seamlessly with core systems, internal users gain access to a comprehensive resource that supports all business and internal functions. This transformation not only enhances operational efficiency but also enables users to manage indicators, statistics, dashboards, and metrics in a standardized and cohesive manner.