-

No-Code

Platform

-

Studio

No-code agentic platform delivering the fastest time-to-value and the highest ROI

-

Studio

-

AI-Native CRM

CRM

-

AI-Native CRM

New era CRM to manage customer & operational workflows

CRM Products -

AI-Native CRM

- Industries

- Customers

- Partners

- About

One platform

to automate insurance workflows and CRM with no-code

Insurance Workflow Map

Insurance agent

Marketing manager

Customer experience

representative

representative

Underwriter

Claims representative

Insurance specialist

HR officer

Sales

Lead management

Streamline lead collection from different sources into a unified database, automate data verification, and craft a custom lead management approach to drive higher conversion rates.

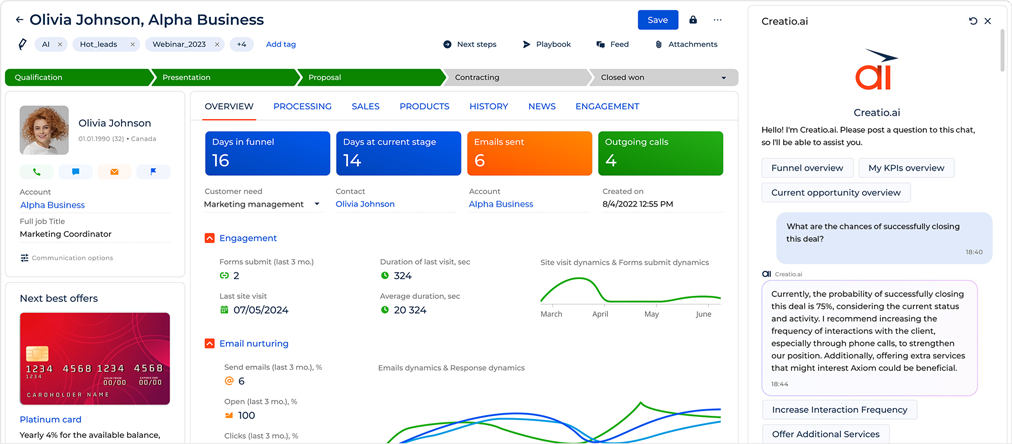

Opportunity management

Manage your opportunities through thorough processes that assist in defining and executing the optimal approach for each prospective client.

Referral management

Track and manage internal and external referrals, and easily create powerful referral programs to generate new business from an existing pool of customers.

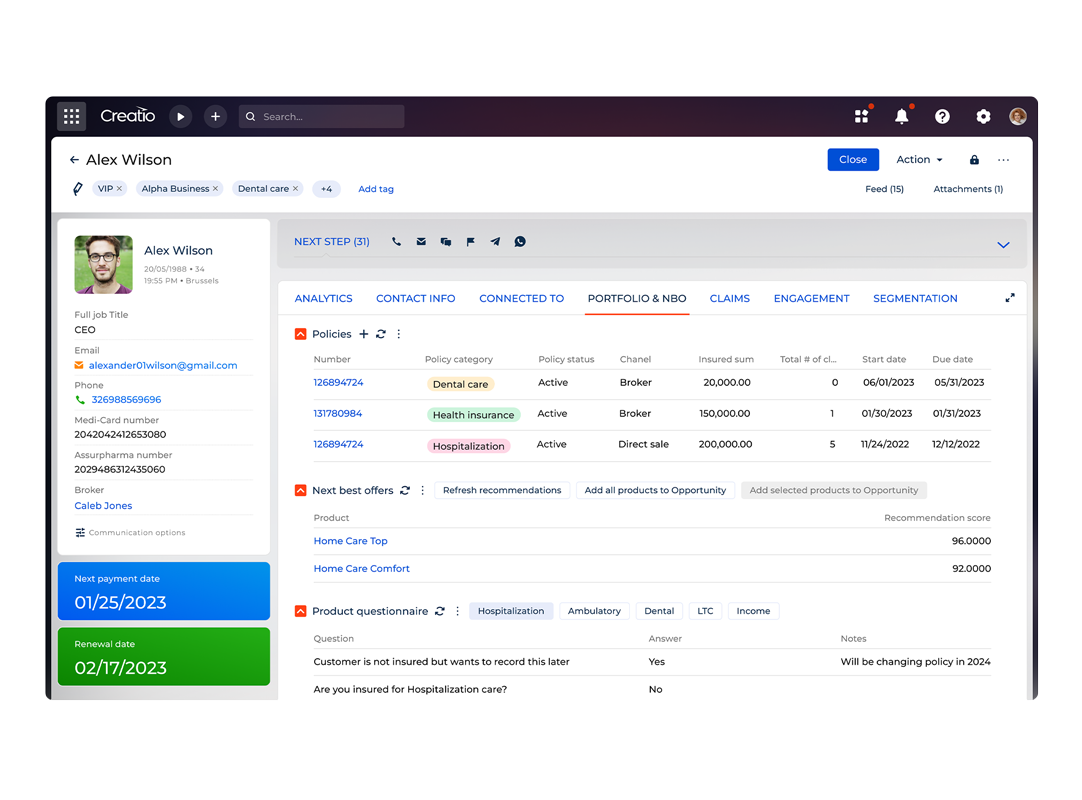

Cross-/Up sales recommendations

Drive customer engagement and cultivate lasting relationships by offering personalized value propositions informed by predictive scoring, AI/ML-powered suggestions, and client's previous interactions.

Consultations

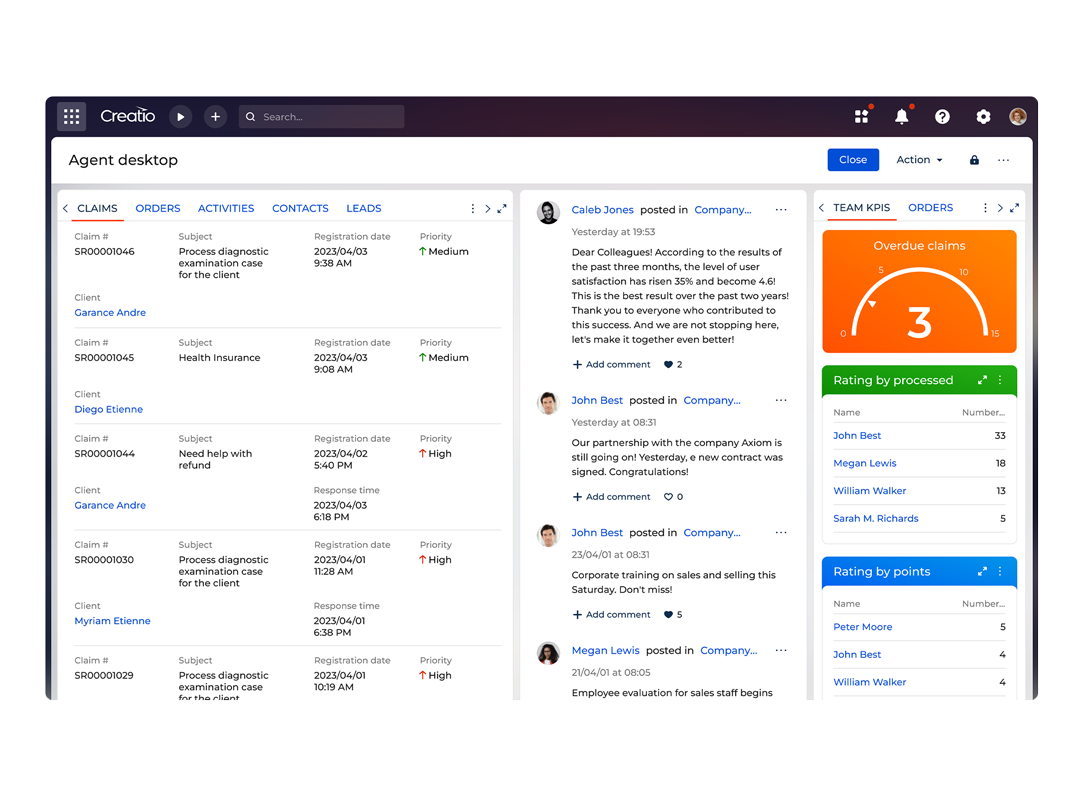

Support your insurance agents in managing their daily tasks, customer requests, and communications through a consolidated digital platform that reduces distractions and optimizes productivity.

Marketing

Segmentation

Establish dynamic customer segmentation using various criteria and reach your audience with tailored offers through the appropriate channel at the right time.

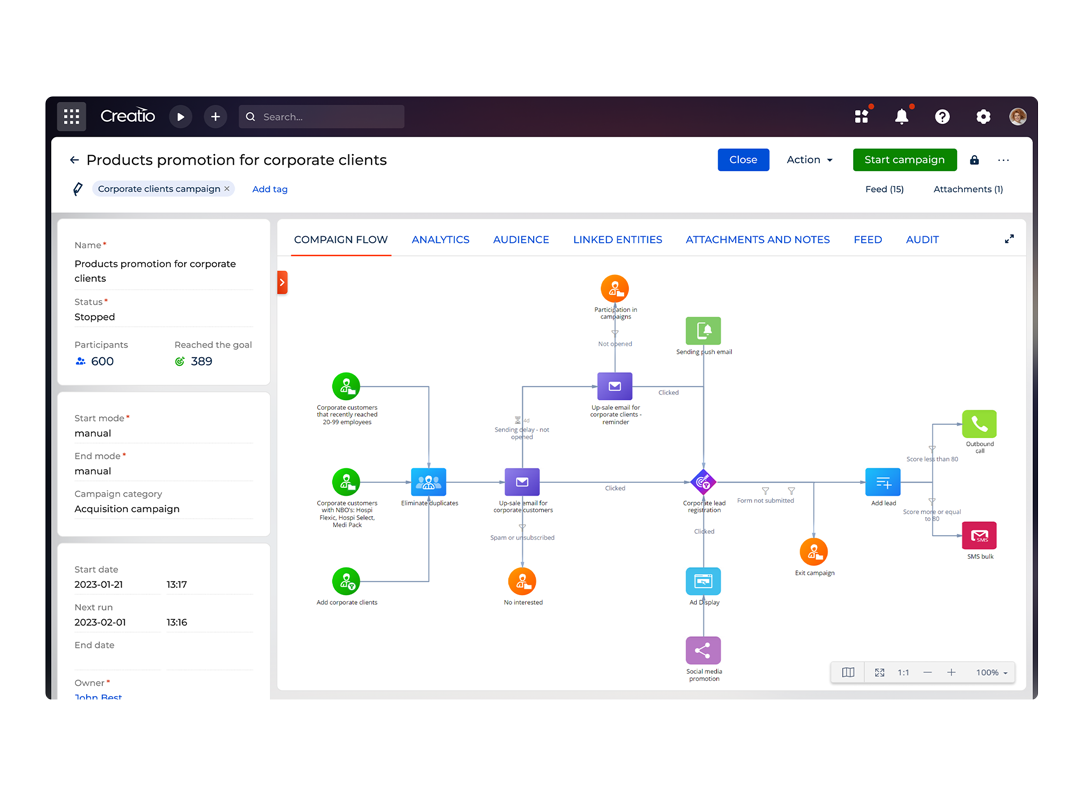

Campaign management

Drive effective lead generation and boost brand visibility by developing, executing, and optimizing large-scale omnichannel marketing campaigns across multiple markets and geographies.

Loyalty & reward programs

Increase customer retention with a sophisticated automated loyalty bonus program, unify and control multiple loyalty solutions in a single system, and assess KPIs to ensure continuous growth.

Event management

Refine organizational processes for managing corporate and client events, and capitalize on promising lead pools by executing well-crafted marketing campaigns aimed at industry events and trade shows.

Onboarding

Know your customer

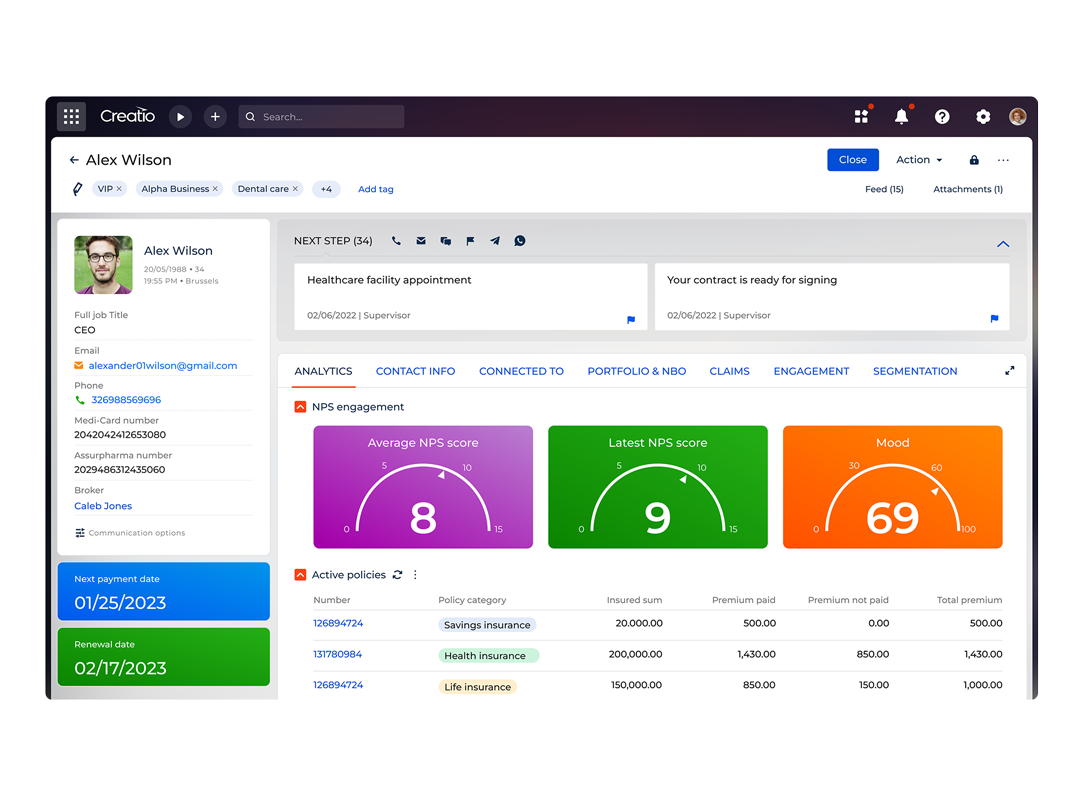

Access an all-encompassing 360-degree view of your customers, featuring their history with your insurance company, current insurance coverage, loyalty programs, and AI-based predictions for upcoming offers and plan improvements.

Engagement analytics

Provide a personalized customer journey experience for each client with an in-depth customer profile analytics, needs analysis, predictive scoring, similar cases suggestions, and other AI-driven insights.

Omnichannel support

Automate processes related to first-time customer onboarding and ongoing support, easily maintain your insurance plans up-to-date, streamline screening and verification routines, speed up approvals, and digitize document management to eliminate errors and maximize customer satisfaction.

Next best action

Maximize customer satisfaction and lifetime value with AI-driven next best action recommendations that help your managers to take the right course of action for each customer.

Underwriting and Verification

Underwriting

Obtain full insight into insurance application data to improve underwriting efficiency and support underwriters with detailed analytics for approving, postponing, denying, or adjusting the final terms.

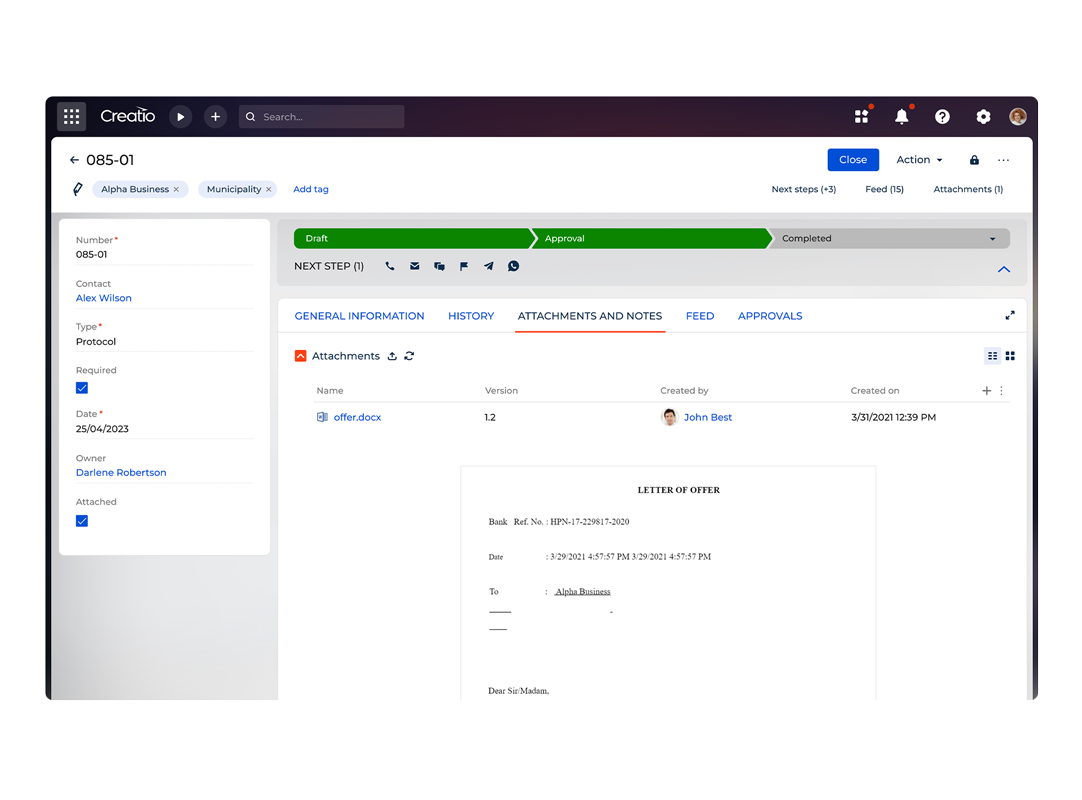

Approval and verification

Guarantee thorough verification of loan application data using adaptable checklists and automated review and approval workflows. Manage verification queues based on priority, accelerate final approvals by reducing manual data entry, setting reminders, and organizing collateral documents.

Document management

Implement a structured and clear document management system that provides centralized access to customer documents, tracks document versions, removes duplicates, synchronizes documents across various workflows, and offers flexible access rights management.

Claims processing

Integrated claims lifecycle management

Automate an insurance claim lifecycle of various types and enforce efficient digital workflows to review, investigate, and resolve claims.

Claims investigation

Collect various customer data from multiple channels, including social media, phone call scripts, third-party investigators, etc. into a single view to simplify investigation processes, prevent fraud, and achieve maximum transparency.

Claims adjustment and appraisal

Digitize claims adjustment workflows and policies to deliver personalized and transparent approach for each client based on the company's best practices, simplify in-field work of your agents with a fully-featured mobile app.

Consultations and customer support

Offer your customers maximum transparency and satisfaction by providing all the data they need to make a better decision on their claim adjustment or changing their insurance products and plans.

Policy administration

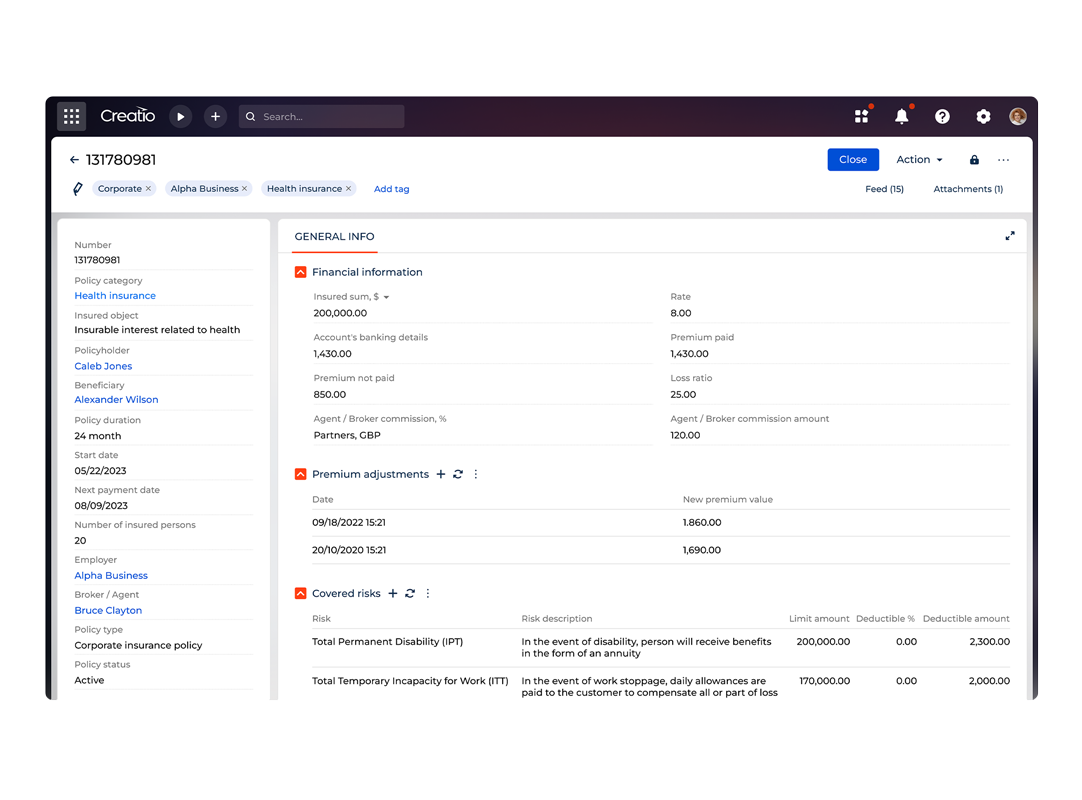

Policy automation

Orchestrate and automate insurance policy lifecycle, reduce time-to-market for new insurance products, and tap into collected customer insights to deliver better customer experiences.

Risk management

Effectively manage risk by consolidating diverse risk data in a single system, automating risk management workflows, and applying rich AI models for predictive scoring and intelligent next-best-action suggestions.

Compliance management

Ensure across-the-board data consistency and regulatory compliance.

Policy data consolidation, integration, and synchronization

Achieve perfect transparency and efficiency by consolidating multiple policy administration apps and data stores into a single environment.

Employee experience

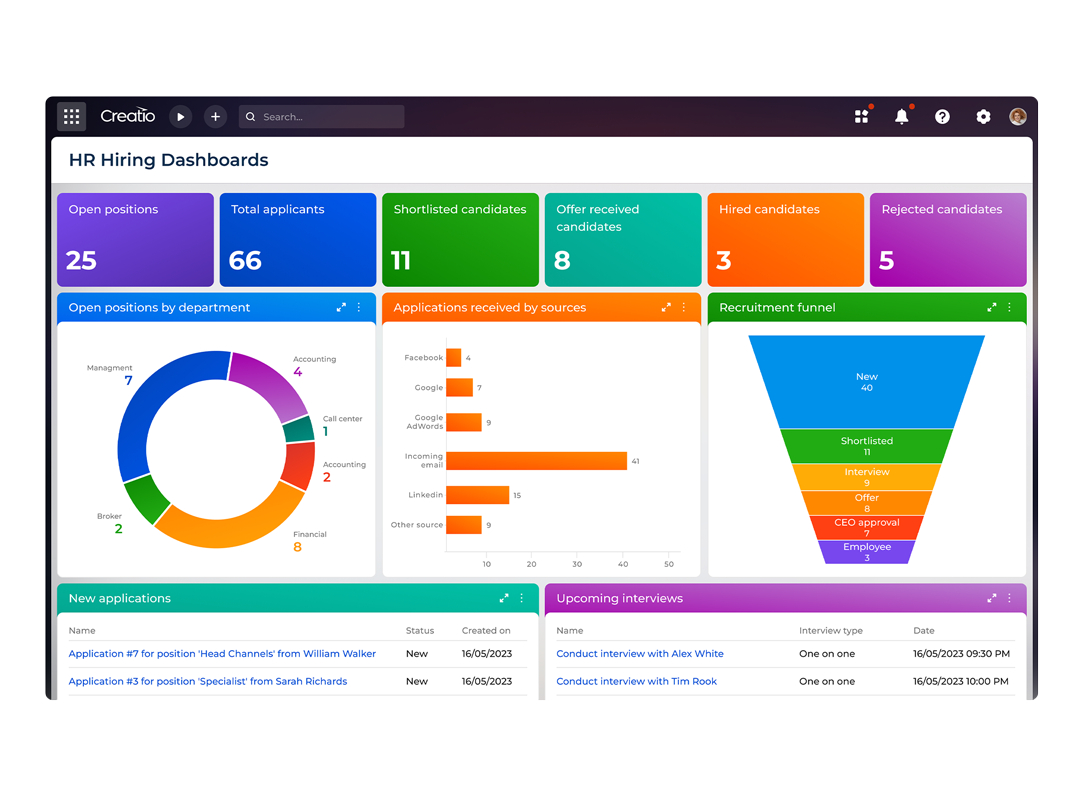

Employee lifecycle management

Implement cohesive HR workflows to manage employees effectively, ensuring transparency and efficiency across hiring, onboarding, development, retention, and exit stages.

Employee request management

Elevate the employee experience by implementing a user-friendly platform that automates requests for vacation, travel, expenses, and more.

Collaboration and knowledge sharing

Unify communications, collaborate seamlessly, share insights and documents, plan tasks and meetings, and coordinate reviews and approvals.

Benefits of Insurance CRM Software

Streamlined Communications

Synchronize and track interactions with clients to ensure seamless communication.

Increased Customer Satisfaction

Personalize interactions, tailor offers, and make relevant recommendations, thus enhancing the customer experience.

Enhanced Productivity

Automate time-consuming and error-prone tasks allowing agents to focus on high-value activities.

Efficient Pipeline Management

Track and manage your sales pipeline and agents’ productivity to increase conversion rates and drive higher revenue.

Better Decision-Making

Make informed data-based decisions with real-time CRM analytics.

Increased Profit

Boost customer retention and drive business profits through effective pipeline management and marketing.

Customer success and genuine care

Ringler Associates is using Creatio’s no-code capabilities to manage a number of business critical applications

Blue Cross Saskatchewan enjoys Creatio’s CRM capabilities to streamline sales and service workflows

Heritage Insurance automates end-to-end case management process with Creatio Service

MetLife Columbia streamlines lead management processes with the help of Creatio’s no-code capabilities

Related Resources

Discover how low-code/no-code technology empowers companies to make the most out of their

digital transformation initiatives

digital transformation initiatives

FAQ

What is insurance CRM?

An insurance CRM (Customer Relationship Management) is a software solution for insurance agents and brokers to manage customer data and automate front-office tasks related to sales, marketing, and customer service. It's specifically designed to accommodate key insurance processes like underwriting, verification and approval, and claims investigation.

Why do insurance agents and brokers need a CRM?

An insurance CRM centralizes customer data and automates interactions, helping manage the customer journey. It allows insurance agents and brokers to deliver consistent, personalized, and timely customer engagement while freeing up time for high-value tasks by automating routine processes.

How important is AI in insurance CRM?

AI technology is transforming the insurance industry by doing more than just enhancing data analysis and automation. Generative AI and machine learning can now create new workflows, design unique customer interactions, and autonomously manage insurance processes.

For instance, Creatio.ai, the AI assistant from Creatio, can take your request to create a new claims investigation workflow and build an automated process where AI handles claim checks and fraud prevention entirely without any human involvement.

How to choose the right insurance CRM?

- Define your goals: Decide if you need to automate specific parts of the customer lifecycle (e.g., sales) or the entire journey, and identify any insurance-specific features required.

- Evaluate integration: Ensure the CRM integrates smoothly with existing tools like email, accounting systems, and insurance platforms for seamless data flow.

- Prioritize customization: Choose a no-code CRM that allows custom workflows and apps to meet your specific needs.

- Ensure scalability: Select a CRM that can grow with your business, offering flexible features and pricing as your operations expand.

- Opt for user-friendliness: Pick a CRM with an intuitive interface for easy adoption and minimal training.

- Check security and compliance: Ensure the CRM has strong security measures and complies with industry regulations.

- Assess support and training: Choose a CRM with reliable customer support and training resources.

- Test before you commit: Use free trials or demos to evaluate the CRM’s performance and fit for your business.

Is Creatio CRM tailored for the insurance industry?

Yes, Creatio CRM offers tailored turn-key solutions to manage client relationships in insurance, including policy management, KYC tools, underwriting, and claim management. Creatio's functionality for insurance agencies is powered by generative AI and no-code tools, which enables quick automation and customization with minimum human involvement.

What is the difference between insurance CRM and AMS?

Insurance CRM and AMS serve different roles. The CRM focuses on building and managing customer relationships to drive sales and marketing efforts, whereas the AMS is centered on managing the day-to-day operations and back-office functions of the agency. Depending on the needs of the agency, both systems may be used in tandem, or a comprehensive solution might offer features from both.

Schedule your guided Creatio demo now

Connect with us to learn how our one platform can help your business to experience the freedom.