-

No-Code

Platform

-

Studio

No-code agentic platform delivering the fastest time-to-value and the highest ROI

-

Studio

-

AI-Native CRM

CRM

-

AI-Native CRM

New era CRM to manage customer & operational workflows

CRM Products -

AI-Native CRM

- Industries

- Customers

- Partners

- About

One platform

to automate mortgage workflows and CRM with no-code

Mortgage Workflow Map

Sales manager

Marketing manager

Branch manager

Service representative

Loan officer

Underwriter

Compliance officer

HR officer

Sales

Lead management

Consolidate leads from diverse sources into one database, automate data verification, and tailor your own unique lead management strategy for maximum conversion success.

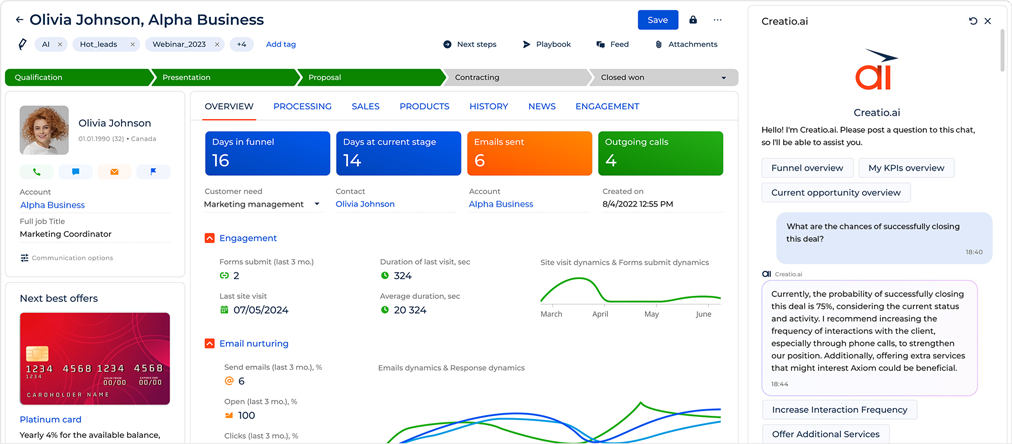

Opportunity management

Streamline the mortgage loan sales process by automating end-to-end workflows and best practices while also easily introducing personalized process automation that helps you follow through the most optimal strategy for each prospect.

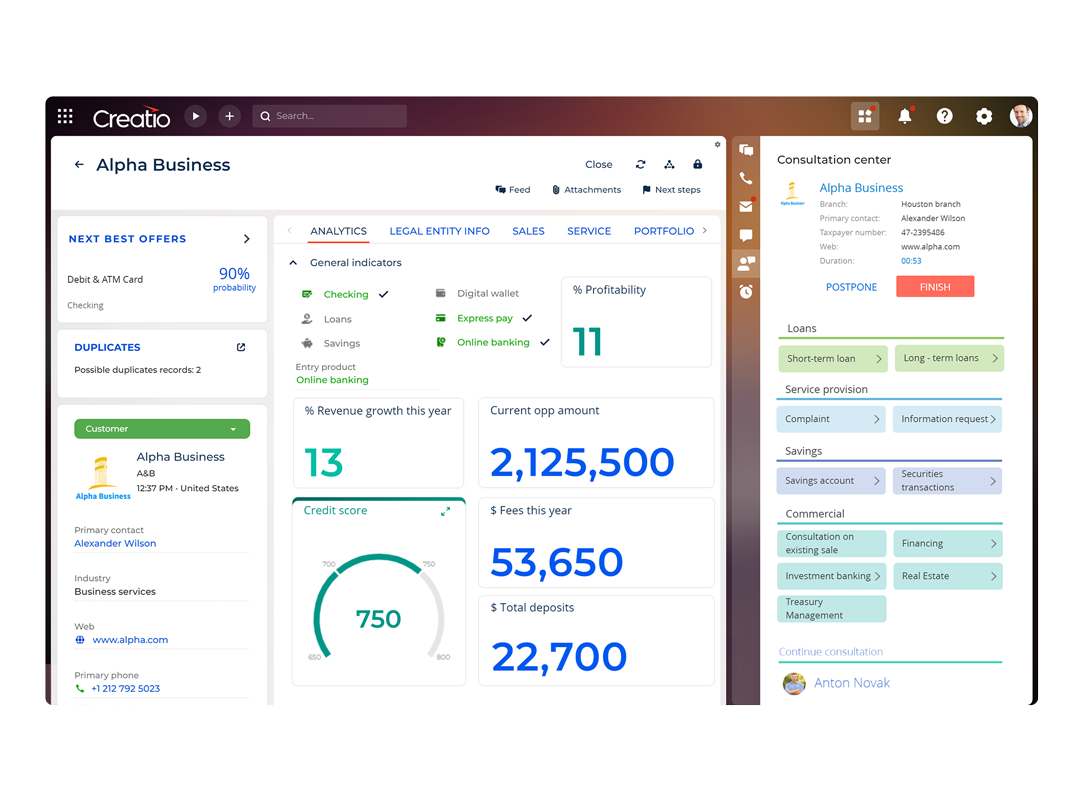

Cross-/Up sales recommendations

Elevate customer engagement and strengthen long-term relationships by delivering tailored value propositions based on predictive analytics, AI/ML-powered next-best-offer intelligence, and previous client interactions.

Sales activity management

Enable your sales reps and front-office staff to streamline their daily tasks, borrower requests, and communications in an integrated digital environment designed for optimal productivity.

Partner and Referral Management

Partner information management

Organize and structure information about your multiple referral partners, including realtors, builders, contractors, and others, for more successful collaboration. Get a quick and convenient access to comprehensive partner information, consolidated in a single detailed partner profile.

Referral tracking

Track how many referrals you get from each partner and who brings the highest quality leads. View up-to-date data on partner's KPIs presented on clear, detailed dashboards and charts.

Joint collaboration

Build effective communication with your partners using an advanced partner portal that supports joint leads and opportunities management, campaign management, knowledge sharing, and more.

Marketing

Segmentation

Configure versatile marketing segmentation by multiples factors and deliver personalized offers to your audience through the most relevant channel at the ideal time.

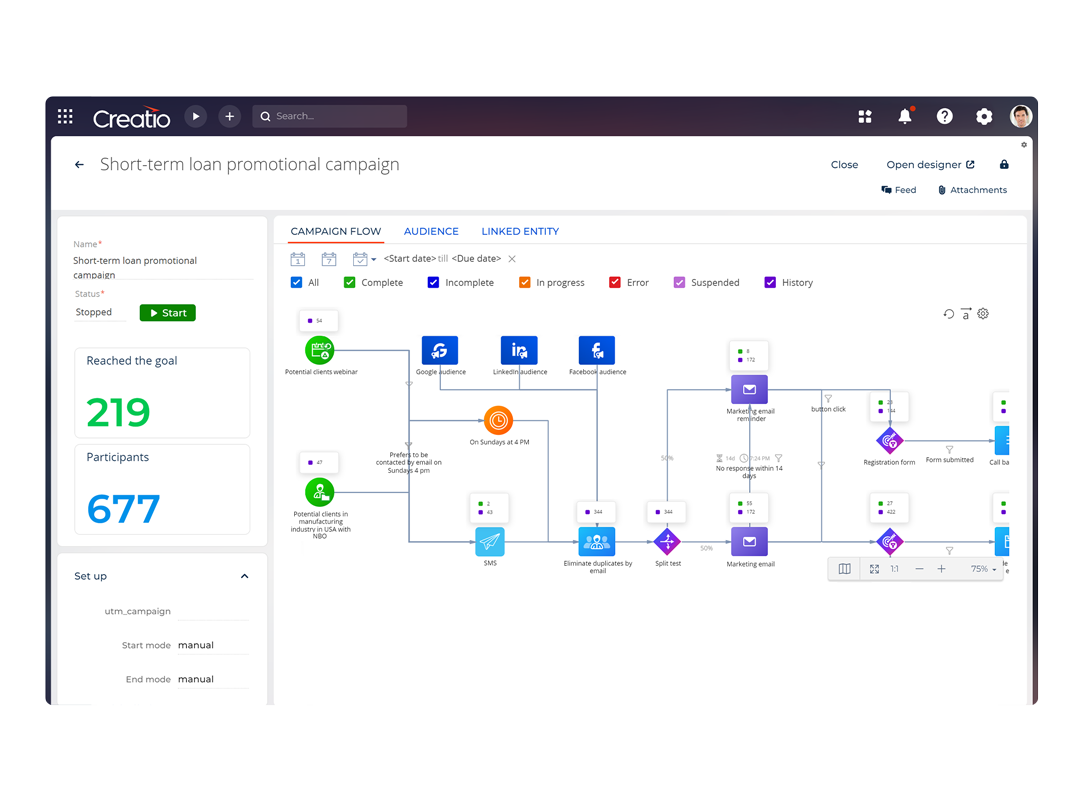

Campaign management

Secure strong lead generation and elevate brand awareness by strategizing, deploying, and optimizing omnichannel marketing initiatives across different mortgage markets.

Email marketing

Personalize email communications with your potential and current borrowers to win their loyalty. Create engaging, professional-looking emails in minutes using the built-in, easy-to-use template designer.

Event management

Streamline organizational processes for online and offline events, as well as tap into high-potential lead pools by executing effective marketing campaigns tailored for industry events and trade shows.

Front-office

Mortgage consultations

Provide professional, high-quality consultations to borrowers using all the necessary insights, knowledge, documents, and communication tools available in a single window interface at your fingertips.

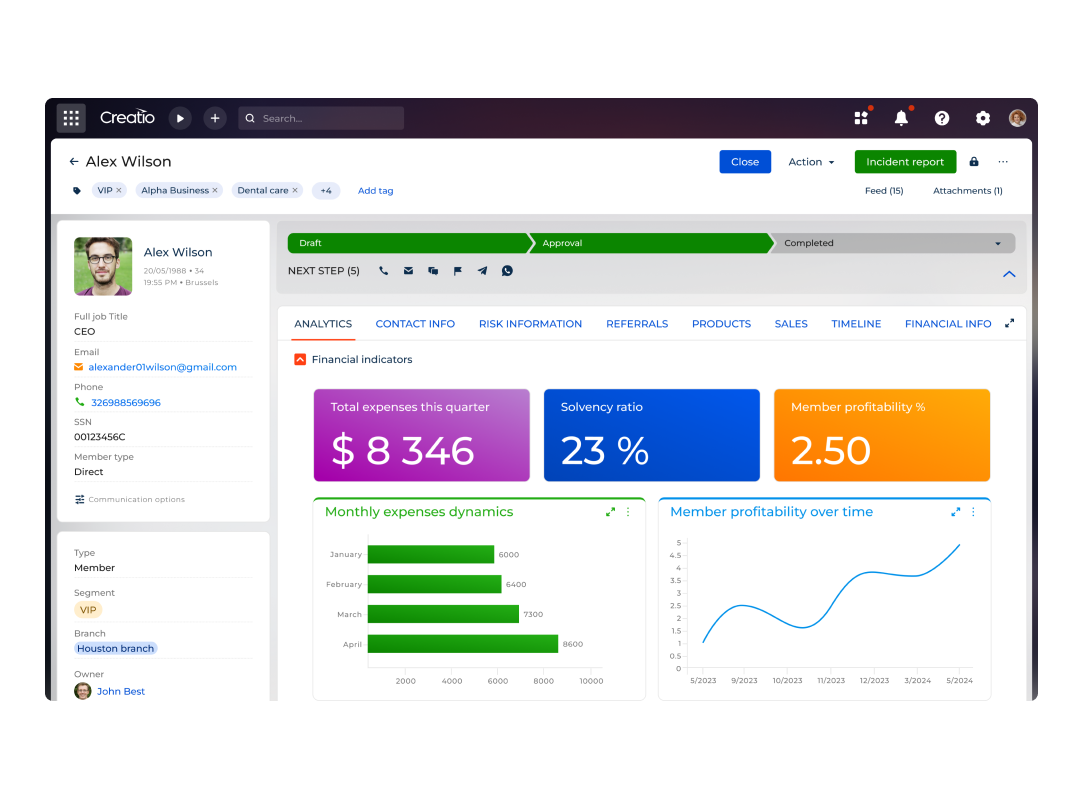

Borrower relationship management

Collect, store, and refer to a comprehensive knowledge about your borrowers – including their needs, preferences, and financial health, as well as all related documents, correspondence, and other data – to provide more consistent communications and make accurate mortgage decisions.

Onboarding

Provide seamless onboarding experience for each borrower, making their entire journey as simple, fast, and engaging as possible. Take full advantage of digital workflows and smart AI/ML tools to automate all required verifications, approvals, and notifications to the maximum, and minimize painstaking manual work and data processing errors.

Mortgage portfolio management

Streamline typical service routines for mortgage products, customer identity verification, and service personalization according to specific customer tiers and service plans.

Borrower Experience

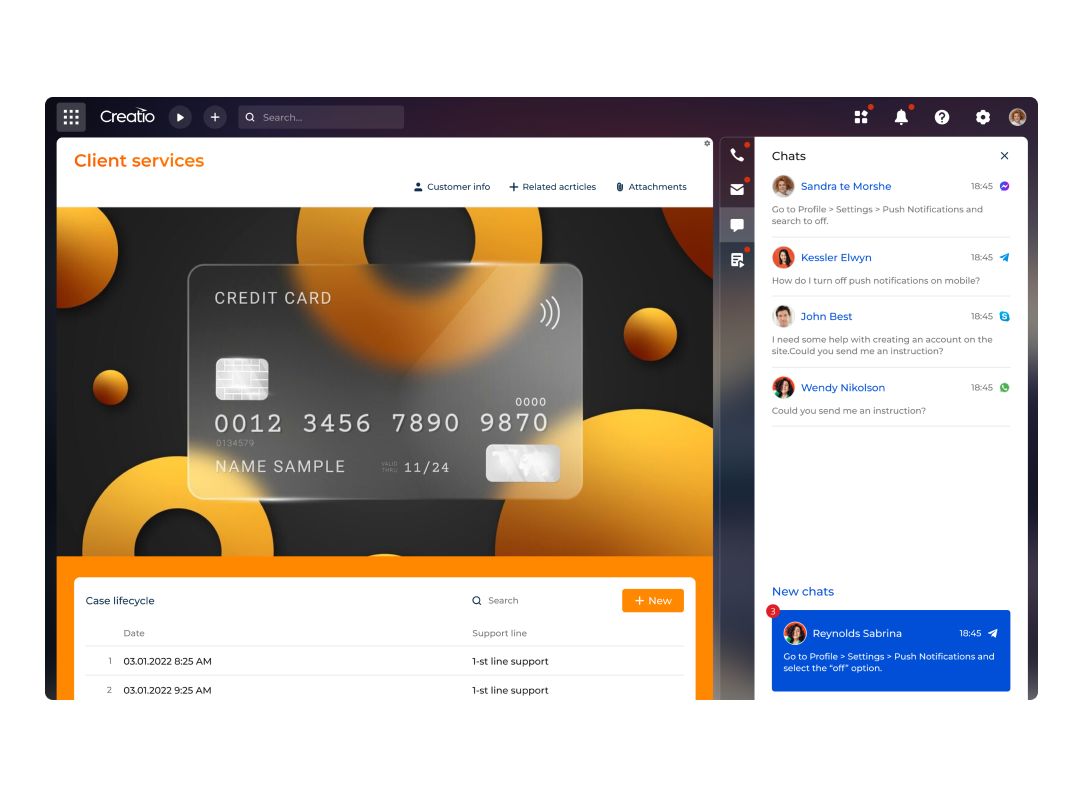

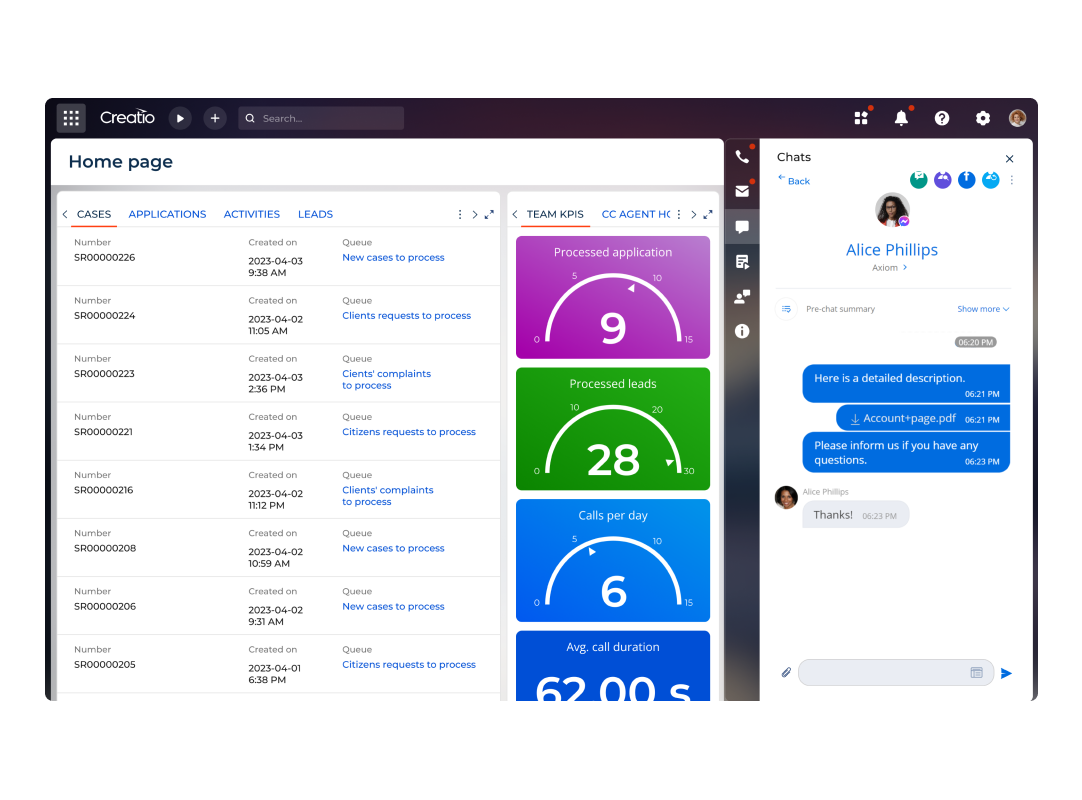

Omnichannel contact center

Maximize the efficiency of contact center operations as well as in-person, chatbot, and digital customer consultations by ensuring automated data synchronization across all customer-facing solutions, databases, and interfaces.

Online self-service

Improve mortgage servicing by giving customers easy access to their loan accounts, including the ability to quickly and easily manage their loan data and communicate with loan officers.

Case management

Accumulate all cases from your customers and partners, classify them into different categories, populate SLA and other data, assign agents and teams - all based on automated digital workflows.

Dispute management

Collect and provide a full visibility into the customer-initiated disputes for all teams involved, streamline teams' collaboration on single-source data, and formalize and automate dispute validation processes to accelerate resolution.

NPS and feedback

Collect, analyze, and manage customer feedback by using measurable KPIs such as Net Promoter Score and implementing digital workflows that are easy to enforce and monitor.

Mortgage Lending

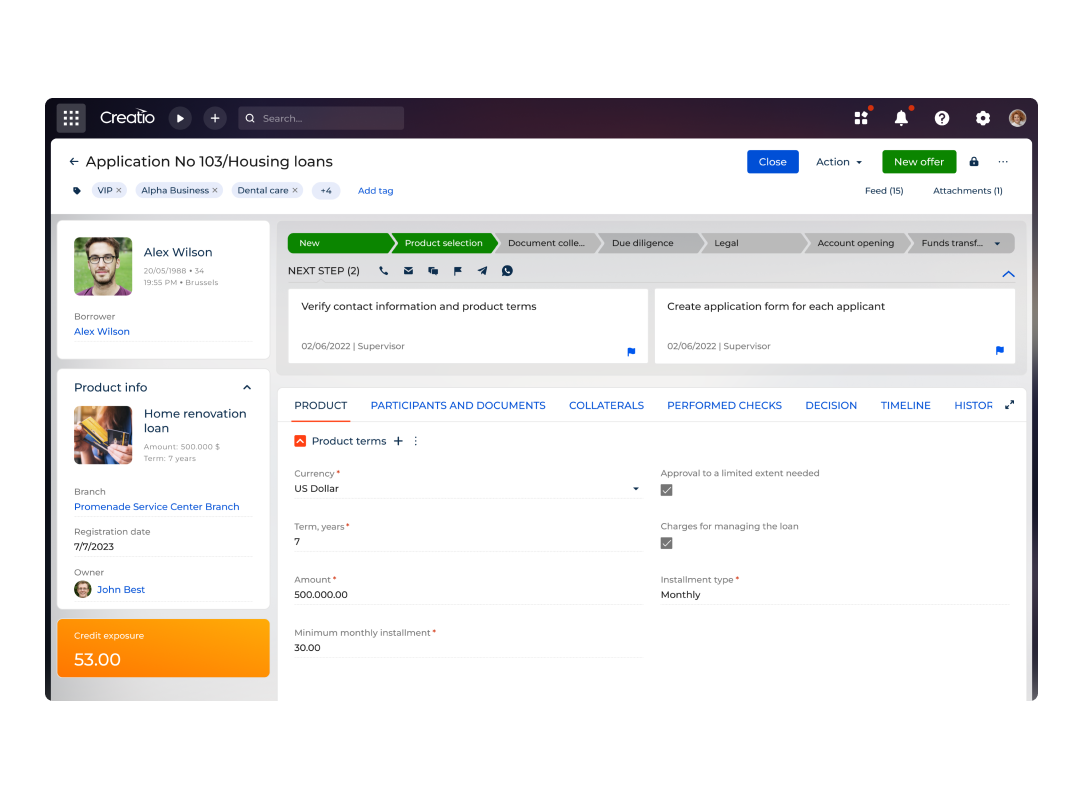

Loan application management

Utilize end-to-end customer data and automated mortgage verification workflows to provide personalized loan terms for each customer, quickly collect approvals from the middle office, and enforce any unique mortgage loan processing policies as part of your company's playbook.

Loan origination

Easily create and enter lending terms, information on lending participants, and collateral documents to ensure fast loan origination and simplify ongoing loan pipeline monitoring.

Loan servicing

Organize the lending process to ensure top-notch customer service, automate loan servicing reminders, deliver loan self-service capabilities, and ensure consistent data updates at every stage.

Loan recovery

Automate loan recovery processes and improve agents' productivity with consolidated communication, analytics, data processing, and reporting tools.

Underwriting and Verification

Underwriting

Obtain thorough visibility into mortgage application data to optimize underwriting processes and support underwriters with detailed analytics for approving, postponing, rejecting, or adjusting financing terms.

Approval and verification

Guarantee comprehensive verification of mortgage application data with customizable checklists and automated review and approval workflows. Handle verification queues according to priority, accelerate the final approval process by limiting manual data entry, and systematically handle reminders and collateral documentation.

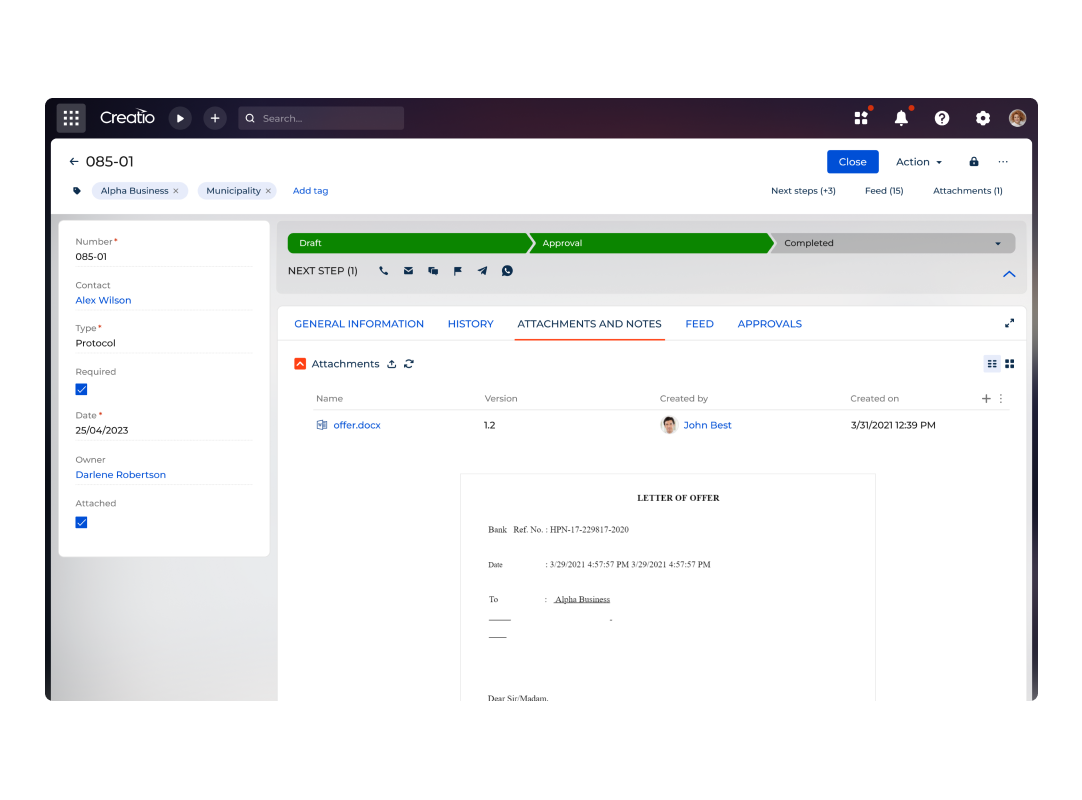

Document management

Keep a streamlined and transparent document management system to facilitate centralized access to customer documents, version control, duplicate elimination, automated document synchronization across workflows, and adaptable access rights management.

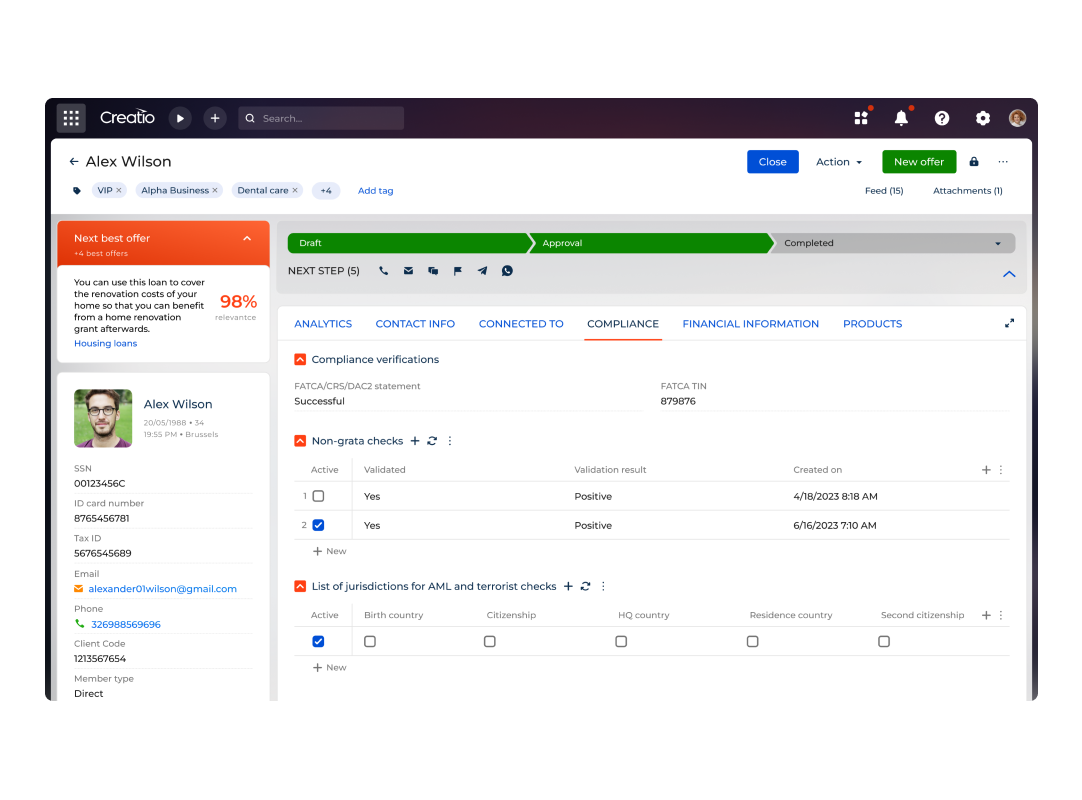

Compliance

Know your customer

Ensure the most complete and accurate customer profile data with a centralized approach based on the unified CRM database, automated data verification and deduplication tools, enterprise-grade data security, and AI/ML-powered business intelligence tools.

Risk catalog management

Digitize your risk catalog and enhance it with intelligent classification, cross-link, and drill-down capabilities to quickly identify, measure, and deal with risk.

Escrow account management

Maintain up-to-date and accurate escrow accounting to ensure that customers' property taxes and insurance payments are processed in a timely manner and conform to state rules and regulations.

Internal audit

Improve the efficiency and accuracy of internal audit by streamlining data collection, verification, and anomaly detection processes via unified workflow automation, automated reports and dashboards, and single-source data storage that eliminates out-of-sync or duplicate data.

Employee Experience

Employee lifecycle management

Establish unified and transparent HR workflows to manage employees effectively, including hiring, onboarding, development, retention, and exit.

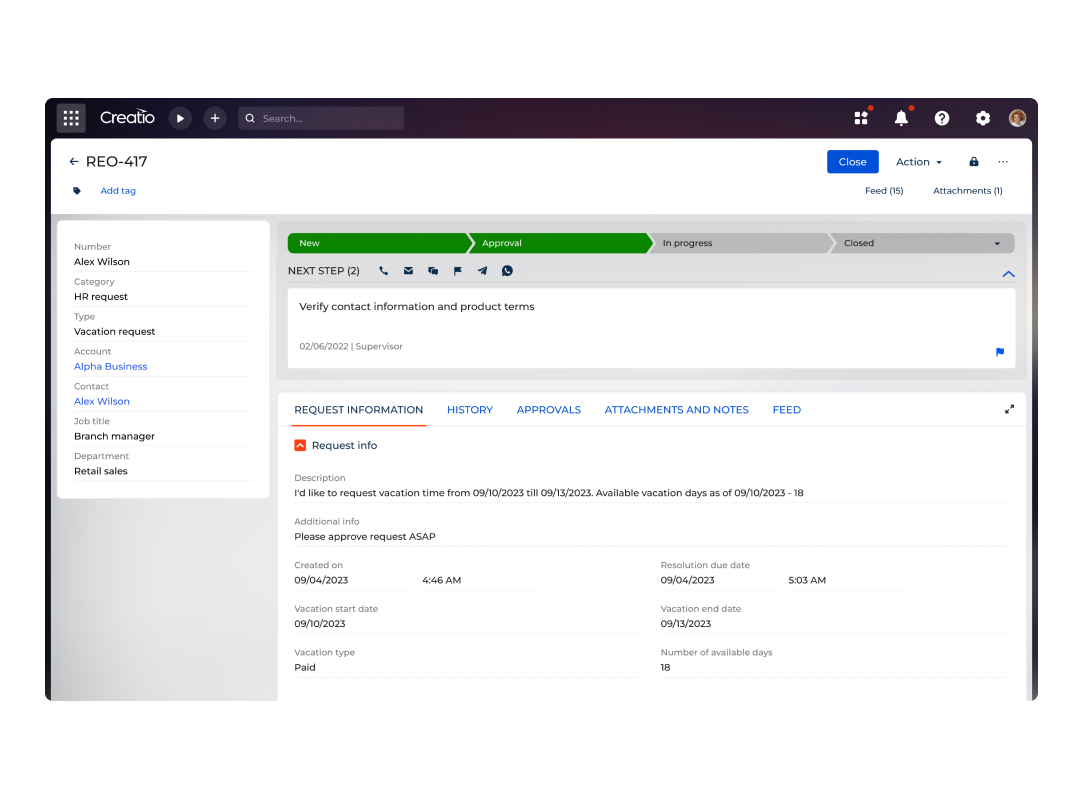

Employee request management

Boost employee experience by implementing a user-friendly solution that automates all types of requests related to vacation, travel, expenses, and other needs.

Collaboration and knowledge sharing

Unify communications, collaborate, share insights and documents, plan tasks and meetings, manage review and approval processes.

Related Resources

Discover how low-code/no-code technology empowers companies to make the most out of their

digital transformation initiatives

digital transformation initiatives

Schedule your guided Creatio demo now

Connect with us to learn how our one platform can help your business to experience the freedom.