-

No-Code

Platform

-

Studio

No-code agentic platform delivering the fastest time-to-value and the highest ROI

-

Studio

-

AI-Native CRM

CRM

-

AI-Native CRM

New era CRM to manage customer & operational workflows

CRM Products -

AI-Native CRM

- Industries

- Customers

- Partners

- About

Enhance Claims Workflows at Scale With Creatio

Claim management is one of the cornerstones in the insurance industry, where you must keep your promises. Delivering a seamless customer experience through claim management and settlement eventually becomes one of your most critical business assets.

A smooth claim processing system makes your clients happy and helps you achieve operational efficiencies through process improvement, real-time monitoring, and control. That’s where modern-day claims management software steps in as an indispensable tool.

Today, we’ll discover why your company should leverage the best insurance claims management software to foster a smooth claims processing system. We’ll also explore the top features of industry-leading tools and examine how they help you.

What is Insurance Claims Management Software?

Insurance claims management software aims to optimize and streamline the claim processing systems for mainstream insurance businesses. From initiation to settlement, these insurance adjusting software products can help you effectively manage every step of your claims handling system.

Let’s take a closer look at how they approach the task.

If we reverse-engineer the insurance claim processing and management system, we’ll find several individual components:

- Data collection

- Document preparation, storage, and analysis

- Communication management

- Claim status tracking

- Initiating claim settlement

- Self-service portal

- Analytics and reporting

Insurance claim management software can handle all these tasks within a single platform and integrate with other external platforms if needed.

So, what does this mean for your business? You’ll enjoy a much faster claim processing timeline and significantly reduce the possibilities of human errors. You can remain agile with your business strategies with real-time insights and embedded analytics.

Benefits of Insurance Claims Management Systems

Insurance claim management software facilitates and accelerates your everyday business operations. Here’s how:

Improved efficiency

With traditional manual data entry and document authentication systems, your claim processing department may take several days to a few weeks to settle a claim. This can result in customer dissatisfaction—not to mention the repeated support calls that will keep your team members busy.

Once you implement an automated claim management and adjustment system, your team can do the same task faster with fewer resources.

Enhanced customer experience

What usually happens when one of your customers submits a claim? There’s always a long queue, typically without any real-time updates.

However, a claim management system allows customers access to a self-service portal to check for current claim progress. This faster and more transparent claims processing, in turn, leads to higher customer satisfaction.

Increased data accuracy

Natural disasters, accidents, or similar events can lead to a significant spike in claims. For your team, this means an increasing volume of tasks to handle with the same resources, leading to potential errors and mistakes.

The adoption of an automated system results in more accurate data entry, calculations, and documentation, minimizing disagreements and rework.

Improved regulatory compliance

To operate legally and keep policyholders' trust, insurance companies must adhere to laws and industry norms. When it comes to regulatory reporting and compliance audits, claims management software helps ensure data integrity and accuracy. Moreover, the storing and retrieval of claim-related reports and documents for regulatory bodies is made much easier by claims management software.

Smarter decision making

Data can make or break a modern-day business. Consider a sudden rise of insurance claims from a specific region. Attempting to analyze it without access to real-time and organized data is similar to walking blind.

Insurance claims processing software solutions can collect and analyze real-time data and customize it with various filters for more straightforward interpretation and enhanced decision making. You can use the analysis to:

- Tailor business policies

- Develop effective outreach programs

- Manage risks better

- Ensure greater profitability

Each advantage of insurance claim management software directly contributes toward your business's success, growth, and sustainability.

Key Features

Insurance claims management software offers several features that make the claim-handling process more streamlined and simplified. Let’s look at the top features so that you can use the knowledge to find the best claims management software for your business.

Claims intake

Capturing the crucial claim details is one of the most demanding steps in the claims handling process. Detailed and organized inputs can significantly ease the processing in the later steps.

Whether the claims come through your website, mail, or a phone call, the software can maintain a unified database and keep all communications seamlessly documented and structured.

Automated workflows

Manual interdepartmental handoffs are time-consuming and resource-intensive. A claim management system, on the other hand, lets you plan the entire workflow with the involvement of team members from multiple departments. The tasks seamlessly transit from one department to another and keep everyone on the same page.

Supervisors can quickly get a birds-eye view of the updated task status. The cherry on top is that the system can also send real-time tracking updates to the customers for enhanced transparency.

Document management

Insurance adjuster software can efficiently digitize your documentation process by:

- Categorizing claim documents

- Storing relevant photos

- Documenting your official claim inspection reports

With advanced searching and indexing filters, you’ll have access to all the necessary resources even on the go. There are no more procedural delays.

Communication tools

You can always rely on your claim processing software to bridge any communication gaps among the stakeholders through plenty of communication tools, such as:

- Built-in integrations with popular email, telephony, and messaging tools

- Web-based portals for claimants

- Real-time task updates and notifications

- One-to-one and group conversations

- File sharing

- Mobile app connectivity

Effective communications with your team members from various departments and with your clients can lead to a trustworthy and transparent business culture.

Analytics and reporting

Lastly, one of the standout features is the data analysis and visualization capabilities. The software can help you identify claim trends, processing times, and other key indicators by scanning a massive database of claim documents. This helps organizations make strategic and operational adjustments and ensure better customer satisfaction.

Top 6 Insurance Claims Management Software in 2026

You can get lost in the sea of available software options. To help you out, here’s our meticulously curated list of the top insurance claims management software.

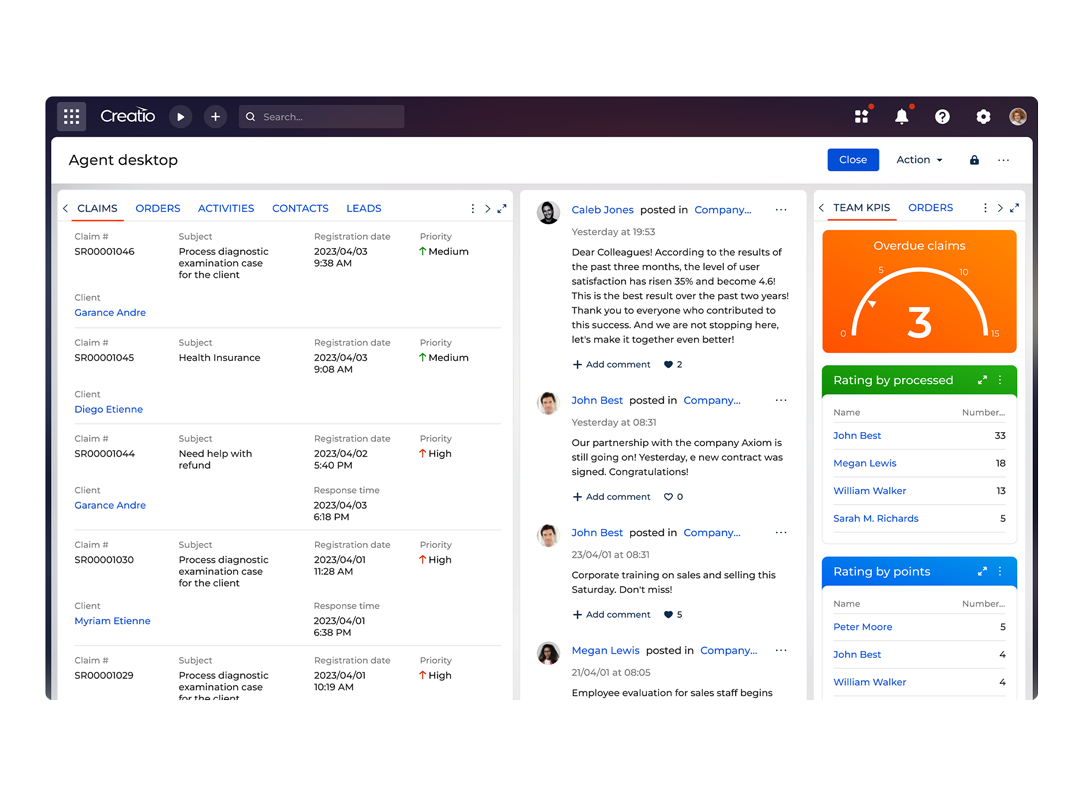

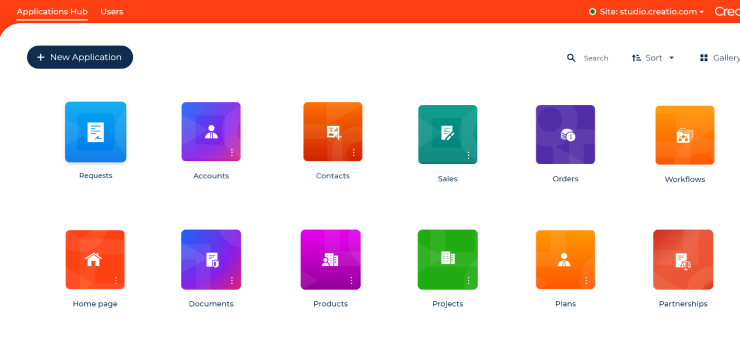

1. Creatio

Creatio is a CRM with a maximum degree of freedom and a no-code platform to automate insurance workflows.

Here are some of Creatio’s top features:

- End-to-end claim cycle automation, from the moment a claim is reported to its final resolution and closure.

- Unified claim investigation by blending and tracking communications from multiple channels and bringing them into a single view.

- Claim adjustment and appraisal with a personalized approach for each client.

- Unified agent desktop to provide prompt and high-quality support for claimants.

- A centralized, well-organized environment for storing and working with customer documents.

- Online self-service portal to empower customers with greater control over their insurance policies, faster access to information, and improved communication with the insurer.

While it lets you manage every aspect of your insurance business, including sales, marketing, onboarding, policy administration, customer service, and compliance management, the solution excels with claims management.

Transform your claims management process with Creatio's innovative software

2. BriteCore Claims

The BriteCore Claims Management solution facilitates claim settlement by bringing together diverse claims management tasks and processes in a centralized place. The software offers all relevant tools, such as FNOL management, reporting, analysis, payments management, etc. Top features include:

- End-to-end claim processing integrating all steps from request to settlement.

- Integrated billing and accounts receivables for quick and transparent payment management.

- Self-service portal for agents, reducing procedural delays.

- Workflow mapping tools for enhanced team coordination.

While customers have generally praised BriteCore for advanced features, the software’s complex dashboard is one of the drawbacks reviewers on Gartner have reported.

3. Guidewire ClaimsCenter

ClaimsCenter by Guidewire is one of the most trusted tools to foster a customer-friendly claims processing system. Here are the top features:

- Giving a comprehensive view of your team's performance based on various metrics related to claim adjustments and other service areas.

- AI-driven cloud environment for instant access to relevant data.

- Rule-based automation to ensure a faster workflow.

4. Snapsheet Claims

Snapsheet provides claims processing software to companies of all sizes. The top features include:

- Extensive range of auto and property claims management with simplified workflow management process for the end-users.

- Integrated reporting and analytics for better insights.

- Template-based communications.

5. EIS ClaimCore

EIS ClaimCore makes it convenient to create rule-based automation and save valuable business resources. The software offers:

- Customer-centric workflow management.

- Extensive fraud detection capabilities that can automatically flag any suspicious claims.

- Monitoring and managing cash reserves.

6. 360SiteView

360SiteView aims to provide your insurance customers with one of the most intuitive claims management experiences. The insurance adjusting software offers:

- An intuitive claims template accessible via the website and mobile app.

- Claim submission and service management portal for team members and customers.

- Customizable templates for various claim types, including motor, property, pet, travel, and more.

Conclusion

A well-designed, feature-rich insurance claims management software is one of your most trusted allies in navigating the challenging insurance business and services landscape. Choosing the right software product can help you bring operational efficiencies and earn customer satisfaction.

The Creatio CRM and no-code platform has proven itself to be an excellent solution for streamlining claim management processes within insurance companies. With an advanced workflow automation engine, Creatio allows insurers to efficiently process claims at various stages, from submission to resolution.

The platform provides quick and convenient access to detailed and always up-to-date information, allowing claims adjusters to make informed decisions promptly. Its user-friendly interface simplifies navigation and interaction with the system, providing a seamless experience for both employees and policyholders.

In addition, simple no-code customization and configuration capabilities allow insurance companies to tailor the platform to their unique preferences, making it a versatile and powerful solution for optimizing claim management operations.